Equity Loan Options: Selecting the Right One for You

Equity Loan Options: Selecting the Right One for You

Blog Article

Trick Elements to Consider When Getting an Equity Financing

When thinking about applying for an equity lending, it is essential to navigate via numerous crucial aspects that can dramatically influence your financial well-being. Comprehending the types of equity financings available, examining your qualification based on monetary aspects, and meticulously taking a look at the loan-to-value ratio are important initial actions.

Sorts Of Equity Finances

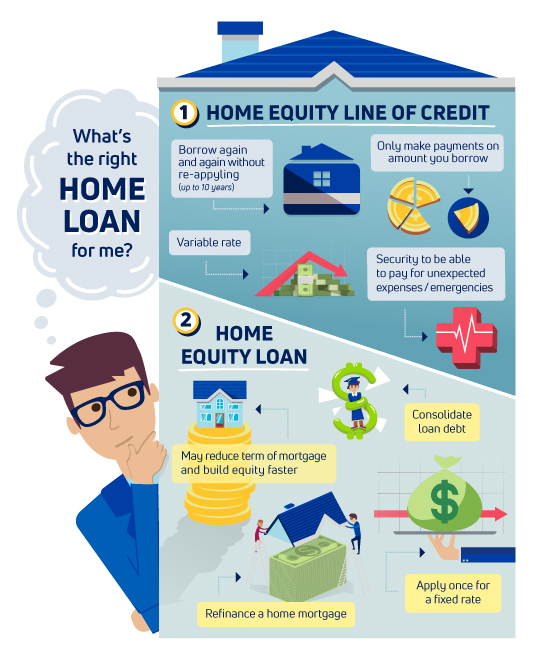

Different financial establishments use a series of equity financings customized to meet varied borrowing demands. One common kind is the conventional home equity funding, where property owners can borrow a swelling sum at a set rate of interest, utilizing their home as security. This sort of financing is excellent for those who require a big sum of cash upfront for a certain function, such as home remodellings or debt loan consolidation.

An additional prominent option is the home equity line of credit report (HELOC), which functions more like a bank card with a rotating credit score limitation based on the equity in the home. Consumers can attract funds as needed, approximately a certain limit, and just pay interest on the amount used. Home Equity Loan. HELOCs are ideal for ongoing costs or jobs with unclear expenses

In addition, there are cash-out refinances, where property owners can re-finance their present mortgage for a higher amount than what they owe and get the distinction in cash money - Alpine Credits Home Equity Loans. This sort of equity finance is beneficial for those wanting to take benefit of reduced rate of interest or access a large amount of money without an additional regular monthly repayment

Equity Funding Qualification Variables

When taking into consideration eligibility for an equity financing, monetary institutions typically assess aspects such as the candidate's credit history rating, income security, and existing financial debt obligations. Income security is an additional key element, demonstrating the consumer's capacity to make regular funding settlements. By carefully examining these variables, financial organizations can figure out the candidate's eligibility for an equity car loan and develop appropriate financing terms.

Loan-to-Value Ratio Considerations

A lower LTV ratio indicates much less danger for the lender, as the borrower has even more equity in the residential property. Lenders normally prefer reduced LTV ratios, as they supply a higher cushion in instance the customer defaults on the lending. A greater LTV ratio, on the various other hand, suggests a riskier financial investment for the loan provider, as the borrower has much less equity in the residential or commercial property. This might lead to the lender imposing greater rate of interest or stricter terms on the lending to mitigate the boosted risk. Debtors ought to intend to keep their LTV proportion as low as feasible to enhance their chances of authorization and protect much more favorable financing find more information terms.

Rates Of Interest and Fees Comparison

Upon examining rates of interest and charges, borrowers can make enlightened decisions pertaining to equity loans. When contrasting equity lending alternatives, it is important to pay very close attention to the rate of interest supplied by different lenders. Rate of interest rates can dramatically affect the total expense of the lending, influencing regular monthly settlements and the complete amount settled over the funding term. Lower interest prices can lead to substantial financial savings gradually, making it essential for borrowers to go shopping about for the most affordable rates.

Apart from passion prices, consumers ought to also consider the various costs linked with equity financings. Early repayment charges may apply if the consumer pays off the loan early.

Settlement Terms Analysis

Reliable examination of payment terms is vital for debtors looking for an equity car loan as it directly impacts the loan's price and economic results. When evaluating repayment terms, consumers must thoroughly review the financing's period, monthly settlements, and any type of potential fines for very early repayment. The loan term describes the size of time over which the customer is anticipated to repay the equity loan. Much shorter financing terms normally result in greater monthly repayments yet lower overall passion expenses, while longer terms offer lower month-to-month repayments yet may bring about paying more passion gradually. Borrowers require to consider their monetary scenario and goals to establish the most appropriate payment term for their demands. Additionally, comprehending any kind of penalties for early payment is crucial, as it can affect the versatility and cost-effectiveness of the financing. By thoroughly examining repayment terms, debtors can make enlightened choices that align with their monetary purposes and make certain successful car loan administration.

Conclusion

In final thought, when using for an equity finance, it is very important to take into consideration the sort of financing readily available, qualification variables, loan-to-value proportion, rate of interest and charges, and payment terms - Alpine Credits. By carefully evaluating these essential aspects, consumers can make educated decisions that align with their financial goals and circumstances. When seeking an equity loan., it is critical to completely research and contrast options to make certain the finest possible end result.

By very carefully evaluating these variables, monetary organizations can determine the candidate's eligibility for an equity financing and establish suitable financing terms. - Equity Loan

Interest prices can considerably impact the general cost of the financing, impacting month-to-month repayments and the total amount settled over the finance term.Effective analysis of repayment terms is vital for customers looking for an equity lending as it straight influences the funding's price and financial results. The loan term refers to the length of time over which the consumer is expected to pay back the equity loan.In final thought, when using for an equity lending, it is crucial to take into consideration the type of funding readily available, eligibility elements, loan-to-value proportion, passion rates and charges, and settlement terms.

Report this page